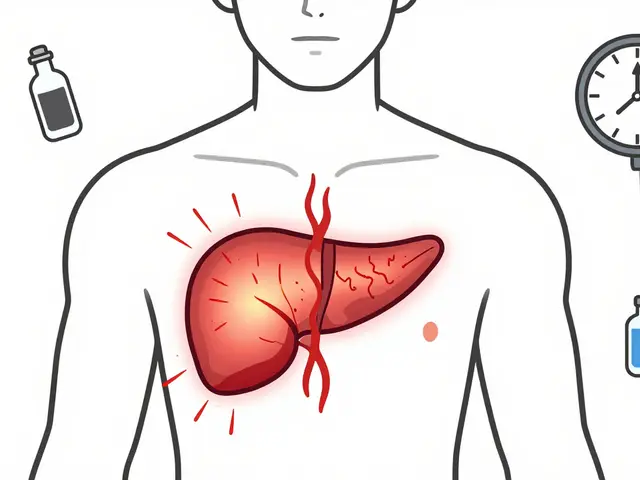

When you’re prescribed a biologic drug like Humira for rheumatoid arthritis or Crohn’s disease, you might expect your insurance to cover it - but what happens when your doctor suggests a biosimilar instead? You could be facing a maze of prior authorizations, confusing tier placements, and out-of-pocket costs that barely budge - even though the biosimilar is just as safe and costs less. This isn’t a glitch in the system. It’s how the system was designed.

What Exactly Are Biosimilars?

Biosimilars aren’t generics. You can’t make them by mixing chemicals in a lab like you do with pills. They come from living cells - same as the original biologic drugs. Think insulin, adalimumab, or etanercept. These are complex molecules made by living organisms, and biosimilars are highly similar versions approved by the FDA after years of testing. The first one, Zarxio, got approval in 2015. By 2025, over 70 biosimilars had been approved, with about 40 actually on the market.

They’re not copies. They’re close matches. The FDA requires them to prove they work the same way, have the same safety profile, and cause no more side effects than the original. But here’s the catch: even though they’re proven safe and cost 10-33% less, insurance companies don’t always treat them like the better deal they are.

Why Are Biosimilars Locked in the Same Tier as the Original?

Most insurance plans use a tier system to control drug costs. Tier 1 is cheap generics. Tier 4 or 5? That’s where biologics live - expensive, high-coinsurance drugs. You pay 25% to 33% of the price out of pocket. A single dose of Humira can cost $5,000. That means $1,250 to $1,650 per month just for your share.

Here’s the problem: 99% of Medicare Part D plans in 2025 put Humira and its biosimilars on the exact same tier. That means if you switch from Humira to a biosimilar like Cyltezo, your monthly cost drops from $1,200 to $1,150. A $50 savings. For a drug that costs $5,000 a month.

That’s not a discount. That’s a rounding error.

And it’s not just Medicare. Commercial plans from UnitedHealthcare, CVS, and Cigna are doing the same. Even though eight different biosimilars for Humira are available, many plans still don’t cover any of them. And when they do, they rarely move them to a lower tier. Only 1.5% of plans give biosimilars a better financial break.

Prior Authorization: The Bureaucratic Wall

If you’re lucky enough to have a biosimilar covered, you still have to jump through hoops. 98.5% of plans require prior authorization for both the original biologic and its biosimilar. That means your doctor has to fill out paperwork - often multiple times - explaining why you need the drug, what other treatments you’ve tried, and why this one is necessary.

Approval can take 3 to 14 days. During that time, you’re not getting treated. For someone with severe arthritis or inflammatory bowel disease, those extra weeks mean more pain, more flare-ups, and more time off work.

And here’s the kicker: no plan requires less paperwork for biosimilars. Even though they’re proven equivalent, you still have to prove you need them - just like the original.

Doctors are drowning in this. A 2024 survey found rheumatologists spend 3 to 5 hours a week just on prior auth requests. One patient waited 28 days to get Humira approved because the plan forced a trial of a biosimilar first - even though the patient had already failed multiple treatments.

Step Therapy: Forcing You to Try the Cheaper Option First

Step therapy is another tool insurers use. It means you have to try the cheapest option before they’ll pay for the one your doctor recommends. For biologics, that usually means trying a biosimilar first - even if your doctor says you’re not a good candidate.

Why? Because it saves the insurer money upfront. But it doesn’t save you time or pain. In fact, it often makes things worse. If you’re on a biosimilar that doesn’t work for you, you have to go back through the prior auth process again to get the original drug. That’s two rounds of paperwork, two delays, and two chances for your condition to get worse.

And the worst part? The biosimilar you’re forced to try might not even be available in your pharmacy. Or your insurance might not cover the dose your doctor needs. So you’re stuck waiting - again - while your body suffers.

Why Are PBMs Blocking Biosimilars?

It’s not just insurance companies. Pharmacy Benefit Managers - or PBMs - like Express Scripts, OptumRx, and CVS Caremark control what drugs get covered and at what price. They negotiate rebates with drugmakers. And here’s the dirty secret: the original biologic makers pay big rebates to stay on formularies. Biosimilars? They don’t pay as much. So PBMs have little incentive to push them.

Some PBMs are starting to flip the script. In 2025, Express Scripts removed Humira entirely from its commercial formularies. Not because they love biosimilars - but because they want you to use the biosimilars they’ve negotiated better deals with. They placed those biosimilars on preferred tiers with lower coinsurance. That’s a win - but only if you’re forced into it.

It’s not about access. It’s about control. And it’s not always transparent.

What’s Changing in 2025?

There’s pressure. The Office of Inspector General found that current coverage practices are slowing down biosimilar adoption. The FTC says it’s anti-competitive. The Congressional Budget Office says we’re leaving $54 billion on the table over the next decade.

CMS is starting to monitor formularies more closely. They’re now requiring plans to report how they place biosimilars and whether they’re treating them differently than the originals. That’s new. And it’s a sign that change might be coming.

Some states are passing laws to ban step therapy for biologics. Others are requiring insurers to cover biosimilars without prior auth if they’re interchangeable. But federal rules are still weak.

What Can You Do?

If you’re on a biologic and your doctor suggests a biosimilar:

- Ask if it’s on your plan’s formulary - and which tier.

- Find out if prior authorization is required - and how long it takes.

- Check if your plan has step therapy rules.

- Ask your doctor to write a letter of medical necessity if you’ve already failed other treatments.

- Call your insurer’s member services. Ask them to explain why the biosimilar isn’t on a lower tier.

And if your plan refuses to cover a biosimilar that’s been approved for years? File a formal appeal. You have rights. And you’re not alone.

The Bigger Picture

The U.S. biosimilar market is growing - from 12% of the biologics market in 2022 to 18% in 2024. But in Europe, biosimilars make up over 80% of the market. Why? Because their health systems actively encourage them. Lower tiers. Fewer restrictions. No step therapy.

Here, we’re letting financial incentives override patient care. We’re letting PBMs and drugmakers decide what’s best for you - not your doctor.

Biosimilars aren’t a gamble. They’re a proven, safer, cheaper alternative. But until insurance rules change, they’ll stay locked in the same expensive tier as the drugs they’re meant to replace. And you’ll keep paying the price.

Are biosimilars as safe as the original biologic drugs?

Yes. The FDA requires biosimilars to prove they are highly similar to the original biologic in terms of safety, purity, and potency. They undergo the same rigorous testing as the original drug, including clinical trials. There is no meaningful difference in how they work or their side effect profile. Over 70 biosimilars have been approved in the U.S., and millions of patients have used them safely since 2015.

Why do I need prior authorization for a biosimilar if it’s cheaper and approved?

Insurance companies use prior authorization to control costs and manage risk - even for drugs that are proven safe. For biosimilars, it’s often a holdover from how they handled the original biologic. Many plans haven’t updated their rules to reflect that biosimilars are equivalent. Some PBMs use prior auth as a barrier to slow adoption, especially if they get rebates from the original drugmaker. The process hasn’t changed, even though the drug has.

Can my pharmacist substitute a biosimilar without my doctor’s approval?

Only if the biosimilar has an "interchangeable" designation from the FDA. Very few biosimilars have this status - mostly low-concentration versions of Humira. Even then, state laws vary. In some states, pharmacists can substitute without telling you. In others, they must notify your doctor. Always ask your pharmacist if substitution is allowed and whether you’ll be informed before it happens.

Why don’t insurance plans put biosimilars on a lower tier to encourage use?

Because the financial incentive isn’t there for insurers. The original biologic manufacturers pay large rebates to stay on formularies. Biosimilars, being newer and less profitable for drugmakers, offer smaller rebates. PBMs and insurers have little reason to move them to lower tiers. Some plans even keep them on the same tier to avoid confusion or because they’re locked into contracts with the originator drug company. Only a handful of plans have started offering better tiers - usually when they’ve excluded the original drug entirely.

What’s the difference between a biosimilar and a generic drug?

Generics are exact chemical copies of small-molecule drugs - like aspirin or metformin. Biosimilars are copies of large, complex proteins made from living cells. You can’t replicate them exactly like a pill. They’re similar, not identical. That’s why they require more testing and why they’re not called "generics." But they’re still approved as safe and effective by the FDA. The complexity is why they cost more than generics - but still less than the original biologic.

How can I find out if my insurance covers a specific biosimilar?

Call your insurance company’s member services and ask for the current formulary. Have the name of the biosimilar ready - for example, "adalimumab-adbm" (Cyltezo) instead of just "Humira biosimilar." Ask if it’s covered, what tier it’s on, and whether prior authorization or step therapy is required. You can also check your plan’s website under "Drug Search" or "Formulary Tool." If the information is unclear, ask your doctor’s office to help - they often have access to pharmacy benefit databases.

Are there any government efforts to improve biosimilar coverage?

Yes. The Inflation Reduction Act requires Medicare Part D plans to cover all biosimilars without cost-sharing barriers. The Centers for Medicare & Medicaid Services (CMS) is now monitoring formulary practices to ensure biosimilars aren’t unfairly restricted. The Office of Inspector General has flagged current practices as anti-competitive. In 2025, CMS began requiring plans to report tier placement and utilization management differences between biosimilars and reference products - a first step toward enforcing fair coverage.

What’s Next?

By 2027, experts predict biosimilars could make up 40% of the biologics market - if insurers stop treating them like second-class drugs. But that depends on enforcement. If CMS starts penalizing plans that don’t put biosimilars on lower tiers, or if Congress passes laws banning step therapy for biologics, adoption will surge.

Until then, patients and providers are stuck in a system that rewards delay over savings. The science is there. The savings are there. The only thing missing is the will to change the rules.

William Liu

Biosimilars are the future, and it’s insane that we’re still treating them like second-class citizens. I’ve been on adalimumab for eight years, switched to a biosimilar last year, and haven’t had a single flare-up. My out-of-pocket dropped from $1,300 to $1,100 - sure, it’s not a miracle, but it’s real relief. The system is broken, not the science.

Dev Sawner

It is an empirical fact that pharmaceutical benefit managers (PBMs) operate under a fiduciary obligation to minimize aggregate cost, not to optimize patient outcomes. The tiering structure is not irrational; it is a rational response to rebate structures that incentivize originator drugs. The notion that biosimilars are being "blocked" is a mischaracterization of market dynamics. The absence of equivalent rebates renders their placement on identical tiers economically coherent.

Moses Odumbe

Let’s be real - this whole biosimilar mess is a corporate circus. 🤡 PBMs get paid to make things complicated. Doctors are spending hours on paperwork instead of seeing patients. And patients? They’re stuck waiting weeks for a drug that’s been FDA-approved for years. I switched to a biosimilar last year and saved $50 a month. That’s not a win - that’s a slap in the face. Meanwhile, the original drugmaker is still getting $4K+ in rebates. Someone’s making bank. It’s not us.

Meenakshi Jaiswal

If you're considering a biosimilar, don't panic - but do your homework. Call your insurer, ask for the formulary, and get the exact name of the biosimilar your doctor recommends (like "adalimumab-adbm" not just "Humira copy"). Many pharmacies won’t automatically substitute unless it’s labeled "interchangeable" - and even then, state laws vary. Bring a printed copy of the FDA’s biosimilar approval info to your appointment. Your doctor can use that to fight prior auth. You’re not asking for a favor - you’re asking for what’s scientifically justified.

bhushan telavane

In India, we don’t have this problem - biosimilars are the norm. Humira? Overpriced luxury. We use biosimilars like Remsima and Benepali. They work. They’re cheaper. No prior auth. No step therapy. Doctors prescribe them first. The system trusts science, not spreadsheets. Maybe if U.S. insurers saw how it’s done elsewhere, they’d stop treating patients like cost centers.

Mahammad Muradov

The idea that biosimilars are somehow being unfairly restricted is a fallacy perpetuated by those who misunderstand pharmacoeconomics. The FDA’s approval process is rigorous, but it does not equate to economic equivalence. The original biologics are protected by patents, and the rebate ecosystem is designed to reward innovation - not to subsidize cost-cutting. To demand lower tiers for biosimilars without equivalent financial incentives is to misunderstand how drug pricing actually functions.

Connie Zehner

I had to fight my insurance for 11 weeks to get my biosimilar approved. They kept saying "we’re reviewing," but I knew they were just waiting for the original drug’s rebate to reset. I cried in the pharmacy parking lot. I’m not even mad anymore - I’m just exhausted. Why does my body have to suffer because someone’s quarterly report depends on me paying $1,200 a month for a drug that’s been copied? 😔

holly Sinclair

There’s a deeper philosophical question here: when does cost-efficiency become moral negligence? We’ve built a healthcare system that treats biological outcomes as line items on a spreadsheet, and we’ve normalized the idea that a patient’s pain is an acceptable variable in a profit model. Biosimilars aren’t just cheaper alternatives - they’re evidence that the original biologics were overpriced by design. The fact that we still require prior authorization for something proven identical is not bureaucratic inefficiency - it’s institutionalized harm. We don’t need more data. We need a moral reckoning. The science has spoken. Now, who will listen?