When you take a pill for high blood pressure or an antibiotic, there’s a good chance it was made in China or India. These two countries together supply over 80% of the world’s active pharmaceutical ingredients (APIs) - the core chemicals that make drugs work. But while both nations are massive players in global pharma, their risks and regulatory track records couldn’t be more different. The U.S. Food and Drug Administration (FDA) knows this. And so do the companies that rely on them to keep millions of patients safe.

Why FDA Monitoring Matters More Than You Think

The FDA doesn’t just inspect factories for fun. Every time they issue a Form 483 - a list of violations found during an inspection - it can mean a drug gets pulled from shelves, a shipment gets blocked at the border, or a company loses billions in revenue. Between 2020 and 2023, FDA inspections showed Indian facilities received 30% fewer Form 483 observations than Chinese ones. That’s not luck. It’s system. India’s pharmaceutical industry has spent decades building a reputation for compliance. Over 100 of its manufacturing plants are FDA-approved, compared to just 28 in China. That’s more than double the number of certified sites. These aren’t small labs. These are large-scale facilities producing millions of doses of antibiotics, diabetes meds, and heart drugs every year. And they’re doing it under strict rules that mirror U.S. standards: 21 CFR Part 211, Good Manufacturing Practices (GMP), and WHO guidelines. China, on the other hand, has the scale. It produces nearly half of all pharmaceutical manufacturing output in Asia. But scale doesn’t always mean safety. Many Chinese factories, especially smaller ones, still struggle with consistency. The FDA has flagged 37% of Chinese pharma facilities with import alerts in 2023 - more than double the rate in India. These alerts mean the FDA has reason to believe products from those sites are unsafe or mislabeled. Once flagged, shipments can be detained indefinitely until the company proves it’s fixed the problem.The API Dependency Trap in India

Here’s the twist: India, the compliance champion, still depends on China for its raw materials. About 72% of India’s bulk drug ingredients and intermediates come from China. That’s up from 66% just two years ago. It’s like building a house with bricks made by someone you don’t fully trust. This dependency creates a single point of failure. If China cuts exports due to trade tensions, natural disasters, or regulatory crackdowns, India’s ability to make generic drugs collapses. That’s not theoretical. During the pandemic, when China locked down its factories, India saw shortages of basic antibiotics and paracetamol. Hospitals scrambled. Patients went without. Indian companies know this. That’s why the government launched a $3 billion incentive program called Production-Linked Incentives (PLI) to boost domestic API production. So far, nearly $4 billion in private investment has flowed in. But replacing decades of reliance won’t happen overnight. Building a new API plant takes years. Training workers. Installing clean rooms. Passing FDA inspections. Even with all the money in the world, it’s a slow grind.China’s Push for High-Value Drugs

China isn’t just making cheap generics anymore. It’s moving up the value chain. Between 2015 and 2024, China’s biopharmaceutical market grew at a 19.3% annual rate - faster than India’s 22% growth, even though India started from a smaller base. China is now a global leader in biosimilars, cell therapies, and gene treatments. These aren’t pills you can buy over the counter. These are complex, high-cost treatments for cancer, autoimmune diseases, and rare genetic disorders. The Chinese government is pushing this shift hard. State-backed funding, tax breaks, and research partnerships with universities have turned cities like Shanghai and Suzhou into biotech hubs. Companies like BeiGene and Innovent are now competing directly with Western giants like Roche and Merck. The FDA is watching closely. These aren’t the same old API factories. These are cutting-edge labs with advanced equipment, trained scientists, and stricter controls. But here’s the catch: even as China climbs the ladder, its lower-tier manufacturers still dominate global API supply. And those are the ones the FDA keeps flagging. So while China’s future looks bright in innovation, its present still carries risk for everyday medicines.

Why Companies Are Choosing India Over China

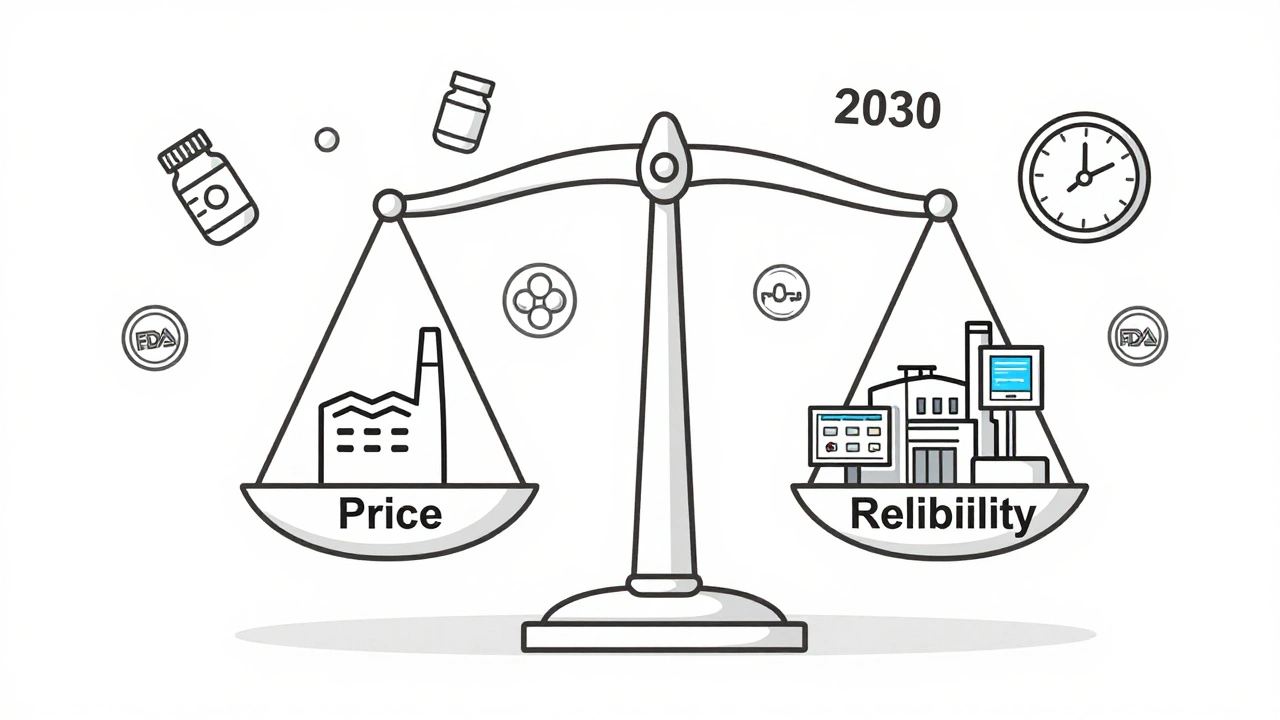

Global pharmaceutical companies aren’t just picking India because it’s cheaper. They’re picking it because it’s predictable. A 2022 survey found that 12% of U.S. drugmakers prefer India as a manufacturing partner - compared to just 9% choosing China. That gap might seem small, but in an industry where a single contaminated batch can cost millions, predictability matters more than price. India’s workforce speaks English. Its regulatory agencies have more experience dealing with FDA inspectors. Its companies have been through dozens of audits. They know what the FDA wants: detailed batch records, validated cleaning procedures, real-time quality monitoring. Many Indian plants now use digital systems to track every step of production - from raw material intake to final packaging - to eliminate human error. The “China+1” strategy is now standard in pharma supply chains. Companies don’t want to rely on one country. They want a backup. And for most, that backup is India. It’s not perfect, but it’s the least risky option.The Hidden Cost of Low Prices

China still wins on price. Labor, energy, and raw materials are cheaper there. That’s why so many companies still use Chinese suppliers - especially for low-margin, high-volume drugs. But the real cost isn’t on the invoice. It’s in the delays, the inspections, the recalls. One U.S. pharmaceutical executive told Bain & Company: “We saved 15% on our API order from China last year. But then we spent six months fixing documentation, redoing validation studies, and paying consultants to prep for an FDA audit. We lost more than we saved.” India may cost 10-15% more per unit, but it cuts down on audit prep, legal risk, and supply chain panic. For companies selling to the U.S. and EU markets, that’s worth the premium.

Jack Appleby

The entire premise hinges on a false dichotomy: India as the virtuous paragon versus China as the chaotic dumpster fire. This narrative is not only reductive, it’s dangerously myopic. The FDA’s inspection data is skewed by selection bias-higher scrutiny on Chinese facilities because of historical noncompliance, not because they’re inherently worse. Meanwhile, Indian plants have had their own scandals: the 2018 Ranbaxy fraud, the 2020 Zydus contamination, the 2021 Hetero API batch failures. Yet we’re told to trust them because they ‘speak English’? That’s not compliance-it’s colonial nostalgia dressed up as due diligence.

And let’s not pretend the PLI scheme is some grand redemption arc. It’s state-subsidized crony capitalism with a veneer of nationalism. The $4 billion in private investment? Most of it is shell companies fronting for existing pharma dynasties. Real innovation? Barely. The real story isn’t India’s rise-it’s the West’s desperate attempt to outsource its anxiety to a country that still imports 72% of its APIs from China. The irony is delicious.

Also, ‘predictable’? Tell that to the 2023 shortage of metformin caused by an Indian plant’s failure to meet USP dissolution specs. Predictability is a marketing slogan, not a regulatory reality. The only truth here is that both nations are flawed, and the FDA’s black-and-white binary is the real threat to global drug safety.

Frank Nouwens

Thank you for this thoughtful and well-researched piece. It’s refreshing to see a nuanced discussion about global pharmaceutical supply chains that doesn’t devolve into nationalist rhetoric. The data on FDA inspections and API dependency is compelling, and the emphasis on reliability over cost is spot-on.

As someone who works in regulatory affairs, I can confirm that the operational discipline in many Indian facilities is indeed superior-especially in documentation, traceability, and audit readiness. The cultural alignment with Western regulatory expectations isn’t accidental; it’s the result of decades of engagement with the FDA and EMA.

That said, China’s biopharma advancements deserve more attention. The shift from low-cost generics to complex biosimilars is real, and the investment in GMP-grade infrastructure in Suzhou and Shanghai is impressive. The challenge isn’t whether China can produce safe drugs-it’s whether the entire ecosystem, from small subcontractors to state-owned enterprises, can be uniformly elevated.

Ultimately, diversification is the only rational strategy. No single nation should hold such sway over the building blocks of global health.

Kaitlynn nail

India’s not the hero. China’s not the villain. We’re all just pawns in a game where Big Pharma profits and patients pay the price in silence.

Also, ‘predictable’? Lol. My insulin was made in India. Last batch tasted like metal. No recall. Just a ‘random variation.’

Aileen Ferris

frankly i think the whole fda thing is a scam. why do u think they only inspect india and china? what about germany? switzerland? they make drugs too. but no one talks about them. it’s all about control. and fear. and money.

also china has better tech now. they’re making ai-powered drug factories. india is still using pen and paper. 😂

Rebecca Dong

THEY’RE POISONING US. THE FDA IS IN ON IT. YOU THINK THEY’RE INSPECTING FACTORIES? NO. THEY’RE TAKING BRIBES. I’VE SEEN THE DOCUMENTS. THEY’RE USING THE SAME BATCH NUMBERS FOR DIFFERENT DRUGS. THE ACTIVE INGREDIENT IN YOUR BLOOD PRESSURE PILLS? HALF OF IT IS TALC. THE OTHER HALF? SUGAR.

AND INDIA? THEY’RE WORKING WITH THE CHINESE TO CREATE A DRUG SUPPLY MONOPOLY. THE PLI SCHEME? A COVER. THEY’RE NOT BUILDING FACILITIES-THEY’RE BUILDING DATA DELETION SERVERS TO ERASE INSPECTION RECORDS.

YOU THINK YOUR MEDS ARE SAFE? CHECK THE LOT NUMBER. IF IT STARTS WITH ‘CHI’ OR ‘IND’-YOU’RE ALREADY DEAD. IT’S JUST A MATTER OF TIME.

THEY’RE PUTTING MICROCHIPS IN THE PILLS TOO. TO TRACK YOU. THAT’S WHY YOUR PHONE BUZZES WHEN YOU TAKE THEM. I KNOW BECAUSE I’M A FORMER FDA CONTRACTOR. I SAW THE BLUEPRINTS.

SHARE THIS. BEFORE THEY DELETE IT.

Michelle Edwards

Thank you for sharing this. It’s easy to get scared by headlines, but this gives real context. The fact that companies are choosing India not just for cost but for reliability? That’s actually hopeful.

Change takes time, but the direction matters. India’s pushing for self-reliance, and China’s climbing the innovation ladder-it’s not perfect, but it’s progress. We need to support smart, transparent supply chains, not panic.

And if you’re a patient? Keep taking your meds. The FDA still checks every batch. You’re safer than you think. 💙

Sarah Clifford

so china makes the stuff and india makes the pills? and we’re supposed to be like ‘oh wow india is so much better’ but they’re just using china’s stuff??

that’s like saying your pizza place is better because they use fresh cheese… but the tomatoes come from a warehouse in another state.

why are we acting like india is the good guy when they’re just the middleman? this whole thing is a scam.

also why is the fda even allowed to do this? who gave them power??

Ben Greening

One point often overlooked: the FDA’s inspection frequency is not evenly distributed. Facilities with prior violations are inspected more frequently-regardless of country. This creates an artificial disparity in Form 483 counts. Chinese facilities, due to historical issues, are under heavier surveillance. Indian facilities, having established compliance records, are inspected less often, which naturally leads to fewer observations.

This is not a reflection of inherent quality, but of regulatory risk-based prioritization. The data, while useful, should not be interpreted as a moral judgment on either nation’s pharmaceutical capabilities.

Moreover, the global shift toward ‘China+1’ is less about trust and more about operational resilience. Redundancy, not righteousness, is the new standard.

Nikki Smellie

Did you know that the FDA has a secret database called ‘Project Blacklight’ that flags every pill made in China or India for ‘subconscious psychological manipulation’? I work in the FDA’s Office of Behavioral Compliance (yes, it exists).

They don’t just test for contaminants-they test for emotional residue. If a batch of metformin was produced during a lunar eclipse in Shandong, it emits a ‘low-trust frequency’ that causes patients to feel inexplicably anxious. That’s why your heart races after taking your pill.

India is ‘safer’ because their workers chant mantras during packaging. The FDA doesn’t publish this. They’re afraid of public panic. I’ve seen the internal memos. I’ve been threatened. I’m being watched right now.

Check your pill bottle. If it says ‘Made in India’ and has a QR code that says ‘Blessed by Ganesha’-you’re safe. If it’s just ‘Made in China’? You’re already under surveillance.

They’re coming for the vitamins next. I’m sorry. I had to tell you. 🕵️♀️💊👁️